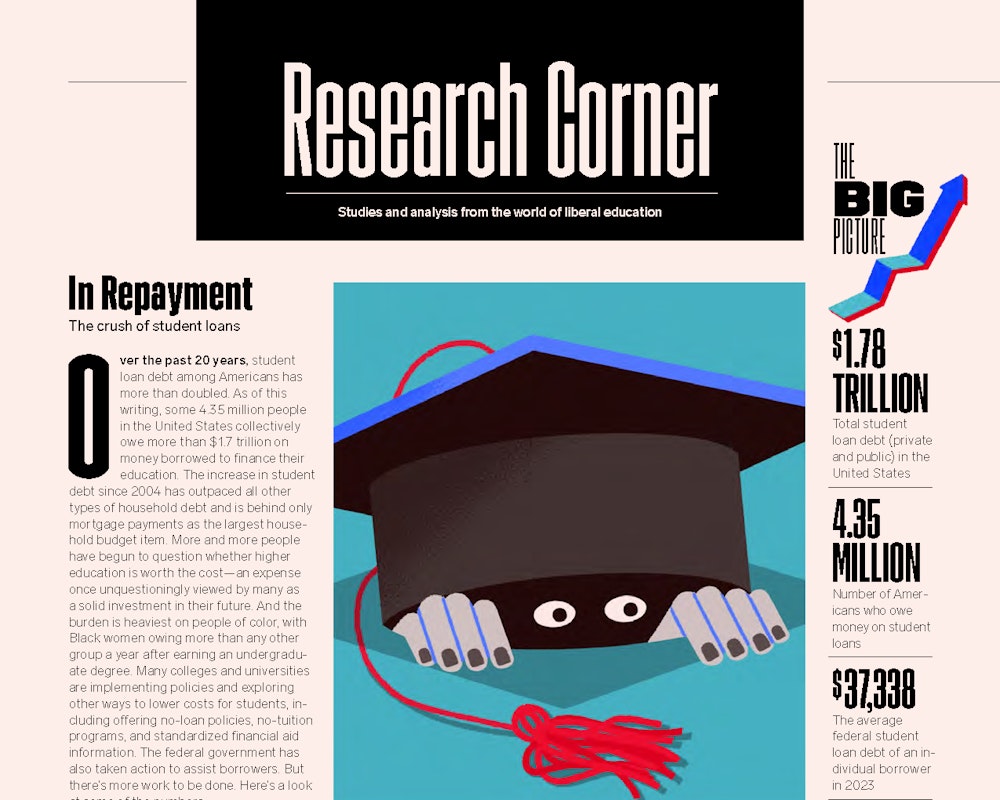

Over the past 20 years, student loan debt among Americans has more than doubled. As of this writing, some 4.35 million people in the United States collectively owe more than $1.7 trillion on money borrowed to finance their education. The increase in student debt since 2004 has outpaced all other types of household debt and is behind only mortgage payments as the largest household budget item. More and more people have begun to question whether higher education is worth the cost—an expense once unquestioningly viewed by many as a solid investment in their future. And the burden is heaviest on people of color, with Black women owing more than any other group a year after earning an undergraduate degree. Many colleges and universities are implementing policies and exploring other ways to lower costs for students, including offering no-loan policies, no-tuition programs, and standardized financial aid information. The federal government has also taken action to assist borrowers. But there’s more work to be done. Here’s a look at some of the numbers.